The Malaysian Transfer Pricing Guidelines elucidate the provision of Section 140A in the Income Tax Act 1967 and the Transfer Pricing Rules 2023. These guidelines establish the criteria and regulations for adhering to the arm’s length principle when dealing with transactions involving associated persons.

Transfer Pricing poses a significant concern as it can be utilised as a means of tax avoidance. The Inland Revenue Board of Malaysia (HASiL) is responsible for upholding tax regulations to guarantee that no instances of tax evasion or avoidance escape scrutiny. Consequently, the Malaysian Government grants HASiL the authority to penalise companies engaging in related party transactions that do not adhere to the arm’s length principle.

Transfer pricing refers to the setting of prices for goods, services, or intangible assets transferred between different entities within a multinational company or related parties in either a same or different tax jurisdictions. It is a critical aspect of international taxation and is used to determine the allocation of profits and costs among different parts of the same multinational enterprise.

The main goal of transfer pricing is to ensure that transactions between related parties are conducted on an arm’s length basis, meaning the prices charged are similar to what would be charged between unrelated, independent parties in similar circumstances. This helps prevent the manipulation of prices for tax avoidance purposes and ensures that each jurisdiction receives an appropriate share of the company’s taxable income.

A related party transaction (“RPT”) is simply any transaction carried out between related parties and can be construed as a controlled transactions. Related parties are defined as follows:-

- Related parties are individuals, entities, or groups who have a direct or indirect relationship with one another.

- The relationship could be through ownership, control, or common interest, influencing the decision-making process.

- Related parties may include individuals and their immediate family members, associated companies, and entities under common control.

- Sale or purchase of goods between a company and its subsidiary or affiliate.

- Provision of services from one related party to another, such as management or technical services.

- Lending or borrowing money between related parties.

- Licensing of intellectual property or technology from one related party to another.

- Leasing of assets, such as equipment or property, between related parties.

- Joint ventures or collaborative projects involving related parties.

- Compensation of executives and employees within the group.

- Transfer of financial instruments, such as loans or derivatives, between related parties.

The arm’s length principle means that transactions between related parties should be conducted as if they were unrelated parties, based on fair market conditions and prices. It prevents preferential treatment and ensures fairness in transfer pricing.

Effective from Year of Assessment 2014, taxpayers are required to confirm in the tax return Form C whether they have prepared contemporaneous transfer pricing documentation (“TPD”) if there was any occurrence of RPT. While the TPD need not be presented to HASiL when submitting Form C, but will have to be made available to HASiL upon request within 14 days from the date of service.

Section 113B(1) of the Income Tax Act 1967 provides that where a company fails to furnish TPD upon request by HASiL, the taxpayer may be prosecuted and, upon conviction be subject to a fine of between RM20,000 and RM100,000 and/or imprisonment of up to 6 months.

Recently, HASiL has been actively engaging in scrutiny mode and has requested numerous taxpayers to provide Transfer Pricing Documentation (“TPD”) for examination purposes.

What is the content of a ?

The Transfer Pricing Guideline specifically outline the information and documentation required for the TPD. This typically includes the followings:

- Organisational structure and business information about the taxpayer

- Nature of business, industry and market conditions under which the taxpayer operates

- Details of the RPTs (controlled transactions)

- Pricing policies including the factors that influenced the setting of such pricing policies

- Functional analysis describing the functions undertaken, risks born and assets utilised by the taxpayer

- Economic analysis and selection of the appropriate transfer pricing method

- Comparability analysis

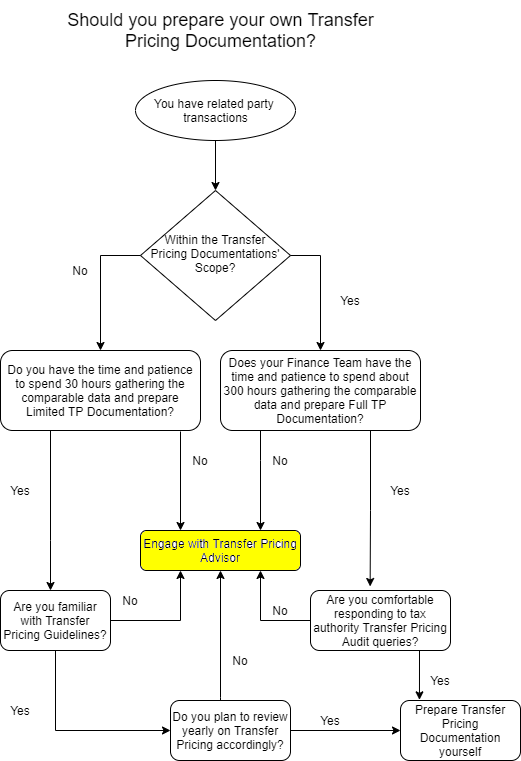

Tax payers meeting the following conditions should prepare a full TPD:-

i) businesses with gross income of more than RM25million and a total RPTs of more than RM15million; and

ii) taxpayers providing financial assistance and such financial assistance is more than RM50million.

For taxpayers who do not fall under the above scope, they may opt to prepare a partial TPD covering specific requirements of the Guidelines.

Read more => Transfer Pricing Guidelines (updated version 2017)

The Income Tax (Transfer Pricing) Rules 2012 require taxpayers to prepare a “contemporaneous” TPD simply means as if any RPT exists, occurs or originating during the same period, a TPD shall be prepared in the basis year for a year of assessment.

At Yer Ant Solutions, we have a team of seasoned experts who live and breathe transfer pricing. With our tailor-made solutions, you can rest assured that your company’s transfer pricing strategies will be efficient, transparent, and compliant with local and international regulations.

Don’t let transfer pricing complexities hold back your company’s growth and success. Get in touch with us today for a complimentary consultation. Let our transfer pricing experts unlock the full potential of your operations while safeguarding you from potential risks. Remember, your financial success is our top priority. Partner with Yer Ant Solutions and step confidently into a profitable future!